I expect a salary between $X and $Y, based on my skills and market rates. I am open to negotiation depending on the overall compensation package.

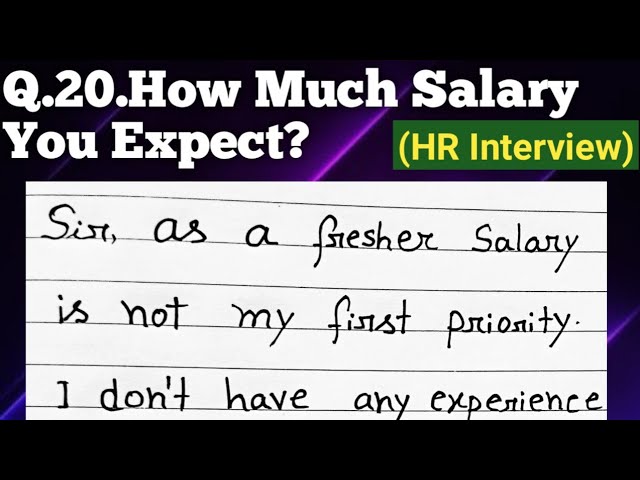

Navigating salary discussions can be challenging. Candidates often feel pressure to provide a specific number while wanting to remain flexible. Researching industry standards helps set realistic expectations. Understanding your worth in the job market is crucial. Be prepared to discuss your skills, experience, and the value you bring to the company.

Effective communication during salary negotiations can lead to a satisfying outcome for both parties. Remember, this conversation is not just about numbers; it’s about aligning your goals with the company’s needs. This approach ensures a productive discussion, paving the way for a mutually beneficial agreement.

:max_bytes(150000):strip_icc()/interview-questions-about-your-salary-expectations-2061235-edit-05e093aeb8934853ac645f38714bd831.jpg)

Credit: www.thebalancemoney.com

Setting The Stage: Evaluating Your Value

Understanding your worth is vital in salary discussions. Knowing your skills and industry standards helps you set realistic expectations. This section guides you in evaluating your value effectively.

Assessing Your Skill Set

Your skill set plays a significant role in salary negotiations. Identify your strengths and unique abilities. Consider these points:

- Technical skills relevant to your field

- Soft skills like communication and teamwork

- Certifications or degrees you possess

- Years of experience in your industry

Make a list of these skills. This list will be a foundation for your salary expectations. The more valuable your skills, the higher your potential salary.

Comparing Industry Standards

Researching industry salary standards is essential. Knowing what others earn helps you gauge your worth. Consider the following:

- Look for salary surveys specific to your industry.

- Use online salary calculators for accurate figures.

- Network with peers to gather insights.

- Check job postings to see salary ranges.

Here’s a simple table to summarize average salaries based on experience:

| Experience Level | Average Salary |

|---|---|

| Entry-Level | $40,000 – $50,000 |

| Mid-Level | $60,000 – $80,000 |

| Senior-Level | $90,000 – $120,000 |

Use this information to define your salary expectations. Align your skills with industry standards for best results.

Factors Influencing Salary Expectations

Understanding salary expectations is crucial for job seekers. Various factors impact how much you can earn. These include your experience, education, location, and market demand for your role.

Experience And Education

Your level of experience greatly affects your salary. More experience often leads to higher pay. Employers value skills gained over time.

Education also plays a key role. Higher degrees may open doors to better-paying jobs. Here’s a quick look:

| Education Level | Typical Salary Range |

|---|---|

| High School Diploma | $30,000 – $40,000 |

| Associate Degree | $40,000 – $50,000 |

| Bachelor’s Degree | $50,000 – $70,000 |

| Master’s Degree | $70,000 – $90,000 |

Location And Cost Of Living

Your location affects salary expectations. Different regions pay differently. Urban areas often have higher salaries but also higher living costs.

Consider these points:

- City salaries may be 20% higher than rural areas.

- Cost of living varies significantly from state to state.

- Research local salary averages before applying.

Demand For Your Role

The demand for your job impacts salary. High-demand roles often have better pay. Industries change, so stay informed.

- Technology jobs are currently in high demand.

- Healthcare roles often pay well due to demand.

- Research industry trends regularly.

Understanding these factors helps set realistic salary expectations. Use this information wisely in your job search.

Researching Salary Ranges

Understanding salary ranges is vital for job seekers. It helps set realistic expectations. Researching provides valuable insights into what others earn in your field. This knowledge empowers you during salary negotiations.

Utilizing Salary Surveys

Salary surveys are great tools for finding salary information. Many organizations conduct these surveys. They gather data from various industries and locations. Here are some popular salary survey sources:

- Glassdoor

- Payscale

- Bureau of Labor Statistics (BLS)

- LinkedIn Salary

These platforms allow you to:

- Search by job title.

- Filter by location.

- View average salaries.

Make sure to compare multiple sources. This will provide a clearer picture of salary expectations.

Networking For Insider Information

Networking can reveal hidden salary insights. Talking to professionals in your field is key. Here are some effective networking methods:

- Join industry-specific groups on LinkedIn.

- Attend conferences and workshops.

- Participate in local meetups.

Ask questions about salary ranges. Most people are willing to share their experiences. This firsthand information is invaluable. It helps you understand the market better.

Calculating Your Salary Needs

Understanding your salary needs is crucial for career planning. Knowing how much you need helps you negotiate effectively. This section will guide you through budgeting and considering benefits.

Budgeting Basics

Start by listing your monthly expenses. This will help you understand your financial needs. Here are some common expenses to include:

- Rent or mortgage

- Utilities

- Groceries

- Transportation

- Insurance

- Entertainment

Once you have your expenses listed, total them up. This total gives you a baseline salary need.

| Expense Category | Monthly Cost |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $150 |

| Groceries | $400 |

| Transportation | $100 |

| Insurance | $200 |

| Entertainment | $100 |

| Total | $2,250 |

Accounting For Benefits And Perks

Salary is just one part of your compensation. Consider benefits and perks that add value. Common benefits include:

- Health insurance

- Retirement plans

- Paid time off

- Bonuses

These can significantly boost your total compensation. Calculate their monetary value. Here’s how to estimate:

- Health insurance: $300/month

- Retirement plan: $200/month

- Paid time off: $150/month

- Bonuses: $100/month

Total these values for a more accurate salary need.

| Benefit | Monthly Value |

|---|---|

| Health Insurance | $300 |

| Retirement Plan | $200 |

| Paid Time Off | $150 |

| Bonuses | $100 |

| Total Benefits Value | $750 |

Combine your expenses and benefits to find your salary need. This approach helps you set realistic salary expectations.

Communicating Your Salary Expectations

Talking about salary can feel tricky. You want to be clear yet diplomatic. Knowing how to communicate your salary expectations helps you negotiate better. Here are some tips to navigate this crucial conversation.

Timing The Conversation

Timing plays a key role in salary discussions. Choose the right moment to bring it up. Here are some tips:

- Wait until the employer mentions salary.

- Discuss salary after a job offer.

- Consider company performance and hiring trends.

- Avoid bringing it up too early in the interview.

Timing helps you appear confident. It shows you respect the hiring process.

Negotiation Strategies

Effective negotiation strategies are vital. Use these methods to communicate your expectations:

- Do your research: Know the market rates for your role.

- Be clear and specific: State a salary range, not a single number.

- Practice your pitch: Rehearse your conversation points.

- Stay professional: Keep emotions in check during discussions.

Consider this table for a quick overview:

| Strategy | Description |

|---|---|

| Research | Understand salary norms for your position. |

| Clarity | Provide a range to show flexibility. |

| Practice | Rehearse to boost confidence. |

| Professionalism | Maintain calm and focused communication. |

Using these strategies can lead to better outcomes. Be prepared, be clear, and stay confident.

Common Mistakes To Avoid

Salary discussions can be tricky. Many candidates make errors. These mistakes can affect job offers. Avoiding them helps secure a better salary. Here are key pitfalls to watch out for.

Underselling Your Worth

Many people undervalue their skills. This leads to lower salary offers. Understand your value before salary talks. Research your experience and skills. Use reliable sources to find your market worth.

- Check industry salary surveys.

- Look at job postings in your field.

- Network with professionals in your area.

Being confident in your abilities is crucial. Share your accomplishments. Highlight projects that showcase your skills. This helps you justify your salary expectations.

Overestimating The Market Rate

Some candidates expect too much. They base their expectations on unrealistic figures. This can lead to disappointment. Know the average salary for your position.

| Experience Level | Average Salary Range |

|---|---|

| Entry-Level | $40,000 – $50,000 |

| Mid-Level | $60,000 – $80,000 |

| Senior-Level | $90,000 – $120,000 |

Use this table as a guide. Adjust your expectations based on your skills. Stay realistic to avoid losing opportunities.

When To Walk Away

Understanding when to decline a job offer is crucial. Accepting a low salary can affect your career. Knowing your worth helps you make better decisions.

Recognizing Lowball Offers

Lowball offers can be easy to spot. Here are some signs:

- Offer is below industry standards.

- Company does not explain salary range.

- Job responsibilities are extensive but pay is low.

Research average salaries for your role. Use websites like Glassdoor and Payscale. Compare those numbers with your offer. Trust your instincts. Accepting less than your worth can hurt long-term.

Evaluating Job Offer Vs. Career Goals

Consider your career path before accepting an offer. Ask yourself these questions:

- Does this job align with my career goals?

- Will I gain valuable skills?

- Is there room for growth and promotion?

Make a pros and cons table. This will help you visualize your decision.

| Pros | Cons |

|---|---|

| Good company culture | Low salary |

| Learning opportunities | Limited growth |

| Work-life balance | Long commute |

Weigh your options carefully. A great job offers more than just a paycheck. Sometimes, walking away is the best choice.

Credit: www.facebook.com

Continuously Updating Your Value

To earn a competitive salary, you must continuously update your value. This means growing your skills and knowledge. Employers want to hire individuals who bring unique skills. Staying relevant in your field is essential for success.

Professional Development

Investing in your professional development enhances your value. It shows employers that you are committed to growth. Here are some effective ways to develop professionally:

- Online Courses: Platforms like Coursera or Udemy offer valuable courses.

- Certifications: Obtain certifications relevant to your industry.

- Workshops: Attend workshops to learn new skills.

- Networking: Connect with industry professionals.

- Mentorship: Seek guidance from experienced professionals.

Each of these methods adds to your skill set. They make you more attractive to potential employers. Track your progress regularly to measure your growth.

Staying Informed On Industry Trends

Staying informed on industry trends keeps you ahead. Knowledge of the latest trends can boost your marketability. Here are some tips to stay updated:

- Subscribe to Industry Journals: Read journals related to your field.

- Follow Influencers: Follow industry leaders on social media.

- Join Professional Associations: Become a member of relevant associations.

- Attend Conferences: Participate in conferences to learn and network.

- Use News Aggregators: Set up alerts for industry news.

Understanding trends helps you identify new opportunities. It also prepares you for potential challenges. Regularly updating your knowledge positions you as a leader in your field.

| Method | Benefits |

|---|---|

| Online Courses | Flexibility to learn at your own pace. |

| Certifications | Demonstrates expertise to employers. |

| Networking | Builds valuable professional relationships. |

| Mentorship | Provides personalized guidance and support. |

Credit: www.cake.me

Frequently Asked Questions

What Is A Reasonable Salary Expectation?

A reasonable salary expectation varies based on experience, industry, and location. Researching industry standards and salary reports can help. Consider your qualifications and the job’s demands when determining your expectations. Aim for a figure that reflects your skills and the market rate.

How To Determine My Salary Range?

To determine your salary range, research job postings and salary surveys specific to your field. Consider your experience, education, and the skills you bring. Networking with professionals can provide valuable insights. Additionally, tools like salary calculators can help you gauge a competitive range.

Should I Disclose My Salary Expectations?

Disclosing your salary expectations can be beneficial but requires caution. It sets the tone for negotiations and shows your understanding of the market. However, be prepared to justify your figure. If possible, wait until the employer brings up the topic to maintain leverage.

What If My Salary Expectations Are Too High?

If your salary expectations are too high, be open to negotiation. Understand the employer’s budget and be flexible with your requirements. Highlight your skills and value to the company to justify your expectations. Consider non-monetary benefits if the salary is lower than desired.

Conclusion

Determining your expected salary is crucial for career growth. Consider your skills, experience, and market trends. Research industry standards to set realistic expectations. Be confident in your worth during negotiations. Remember, a well-informed approach leads to better outcomes. Empower yourself with knowledge, and you’ll navigate salary discussions with ease.