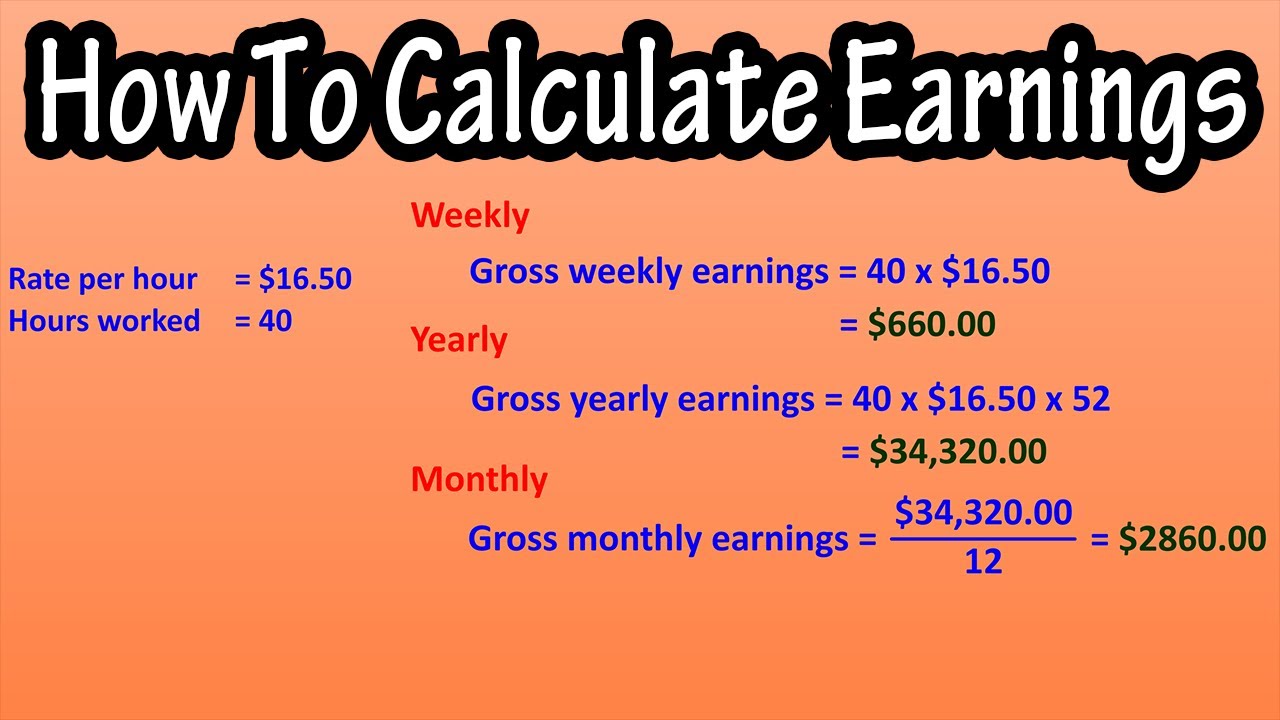

To calculate salary, determine the hourly wage or annual salary first. Then, multiply by the number of hours worked or divide the annual salary by 12 for monthly income.

Calculating your salary accurately is crucial for budgeting and financial planning. Understanding your earnings helps you make informed decisions about spending, saving, and investing. Different factors influence salary, including hourly rates, bonuses, and overtime pay. Knowing how to break down these components allows you to grasp your total compensation.

This knowledge is especially important during job negotiations and performance reviews. Whether you are salaried or hourly, mastering salary calculation empowers you to advocate for yourself effectively. In today’s competitive job market, being aware of your worth can lead to better financial outcomes and career growth.

Breaking Down Salary Calculation

Understanding how to calculate salary is essential for employees and employers. It involves two main components: gross pay and deductions. Let’s explore these components in detail.

Determining Gross Pay

Gross pay is the total amount earned before any deductions. It includes various elements:

- Base Salary: The fixed annual amount paid.

- Overtime Pay: Extra pay for hours worked beyond the regular schedule.

- Bonuses: Additional compensation for exceptional performance.

- Commissions: Earnings based on sales made.

To calculate gross pay, follow this formula:

Gross Pay = Base Salary + Overtime Pay + Bonuses + Commissions

For example, consider this table:

| Component | Amount |

|---|---|

| Base Salary | $50,000 |

| Overtime Pay | $5,000 |

| Bonuses | $3,000 |

| Commissions | $2,000 |

| Total Gross Pay | $60,000 |

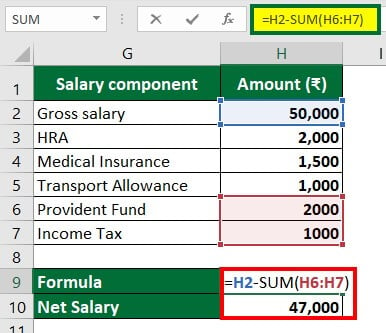

Understanding Deductions

Deductions reduce gross pay to determine net pay. Common deductions include:

- Taxes: Federal, state, and local taxes.

- Health Insurance: Premiums for medical coverage.

- Retirement Contributions: Funds for future savings.

- Other Deductions: Union dues or wage garnishments.

To calculate net pay, use this formula:

Net Pay = Gross Pay - Total Deductions

For better understanding, here’s an example:

| Deductions | Amount |

|---|---|

| Taxes | $12,000 |

| Health Insurance | $3,000 |

| Retirement Contributions | $2,000 |

| Total Deductions | $17,000 |

Using the previous gross pay example, the net pay calculation would look like this:

Net Pay = $60,000 - $17,000 = $43,000

Understanding these components helps ensure accurate salary calculations. It empowers employees to know their earnings better.

Types Of Salary Structures

Understanding different salary structures helps you assess your earnings. Each structure has unique features. Here are the main types.

Hourly Wages

Hourly wages are paid based on the number of hours worked. This structure is common for part-time jobs and hourly positions.

Employees receive a fixed amount for each hour. If they work overtime, they often earn more. Here are some key points:

- Paid for actual hours worked.

- Overtime rates apply after a certain number of hours.

- Ideal for temporary or seasonal jobs.

Annual Salaries

Annual salaries offer a set amount paid each year. This structure is typical for full-time positions.

Employees receive consistent paychecks, usually monthly or bi-weekly. Here are some advantages:

- Stable income throughout the year.

- Predictable budgeting for employees.

- Often includes benefits like health insurance.

Commission-based Earnings

Commission-based earnings depend on sales or performance. This structure is common in sales roles.

Employees earn a percentage of the sales they generate. This can lead to higher income for top performers. Key aspects include:

- Incentives for high performance.

- Variable income based on sales.

- Motivates employees to exceed targets.

Pre-tax Deductions Explained

Understanding pre-tax deductions is essential for calculating your salary. These deductions lower your taxable income. This means you pay less in taxes. Pre-tax deductions can impact your take-home pay significantly.

Retirement Contributions

Retirement contributions help you save for the future. Common plans include 401(k) and IRA. Here’s how they work:

- Money goes from your paycheck directly to your retirement account.

- This reduces your taxable income.

- Employers often match contributions, boosting your savings.

Example of a 401(k) contribution:

| Monthly Salary | Contribution (5%) | Taxable Income |

|---|---|---|

| $3,000 | $150 | $2,850 |

Healthcare Premiums

Healthcare premiums are payments for health insurance. These are deducted from your paycheck before taxes. Here’s what you should know:

- Premiums reduce your taxable income.

- They ensure you get health coverage.

- Plans vary in cost and coverage.

Example of healthcare premiums:

| Monthly Salary | Premium Cost | Taxable Income |

|---|---|---|

| $3,000 | $200 | $2,800 |

Flexible Spending Accounts

Flexible Spending Accounts (FSAs) let you save for medical expenses. You can set aside money before taxes. This reduces your taxable income:

- You decide how much to contribute each year.

- Funds can be used for eligible expenses.

- Unspent funds may not roll over to the next year.

Example of FSA contributions:

| Monthly Salary | FSA Contribution (10%) | Taxable Income |

|---|---|---|

| $3,000 | $300 | $2,700 |

Credit: www.wikihow.com

Post-tax Deductions To Consider

Understanding post-tax deductions is important for accurate salary calculations. These deductions impact your take-home pay. Knowing them helps in budgeting and financial planning.

Garnishments

Garnishments are court-ordered deductions from your paycheck. They often arise from unpaid debts or legal issues. Common types include:

- Child support

- Tax levies

- Civil judgments

Garnishments can significantly reduce your net income. Always check your pay stub for these deductions.

Union Dues

Union dues are fees paid to a labor union. These fees support union activities and services. Union members usually pay monthly dues. Here are key points:

- Dues vary by union.

- They can be a flat fee or a percentage of salary.

- Union members benefit from collective bargaining.

Ensure to include union dues in your calculations for accurate take-home pay.

Post-tax Retirement Plans

Post-tax retirement plans allow you to save for the future. Contributions occur after taxes are deducted. Common plans include:

| Plan Type | Tax Treatment |

|---|---|

| Roth IRA | Contributions are taxed, withdrawals are tax-free. |

| After-Tax 401(k) | Contributions are taxed, potential tax-free growth. |

Post-tax contributions can help grow your retirement savings. Factor these into your salary calculation for better planning.

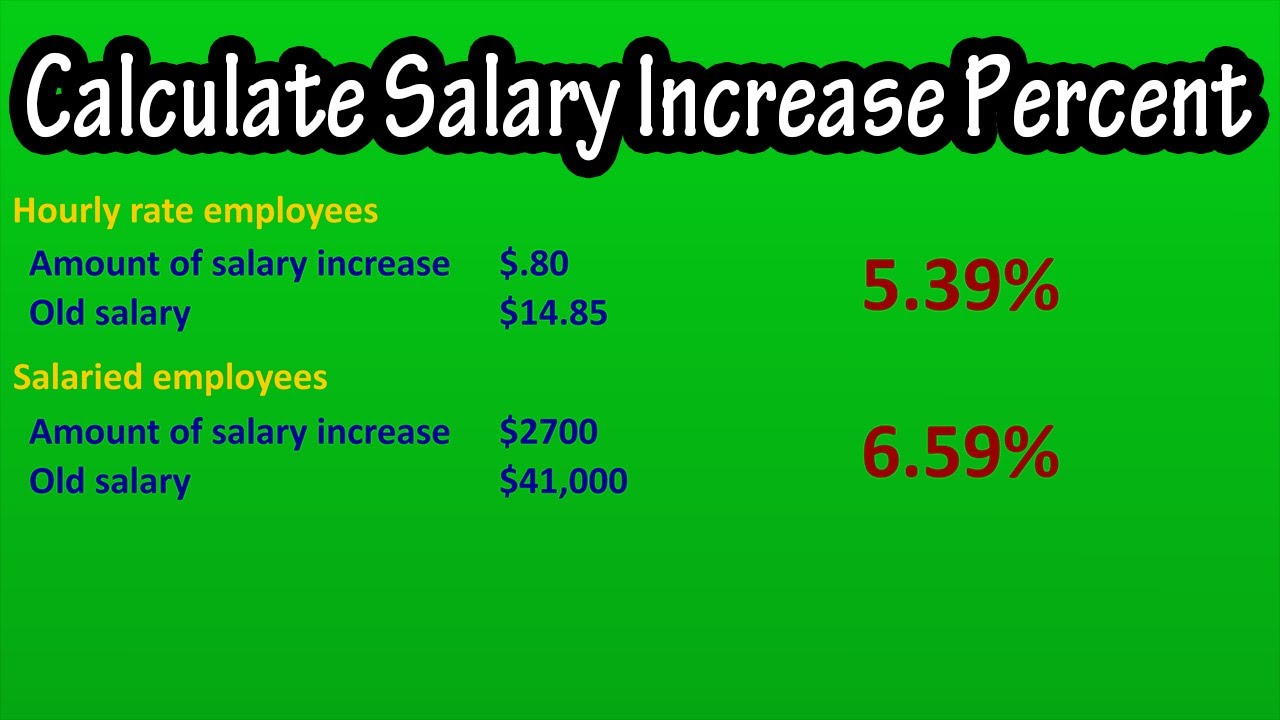

Incorporating Bonuses And Overtime

Understanding how to incorporate bonuses and overtime into your salary calculation is essential. These components can significantly boost your overall earnings. Knowing how to calculate them accurately ensures fair compensation.

Calculating Overtime Pay

Overtime pay applies when employees work more than their regular hours. It often comes at a higher rate, usually 1.5 times the regular pay rate. Here’s how to calculate it:

- Determine your regular hourly wage.

- Identify the number of overtime hours worked.

- Multiply your hourly wage by 1.5.

- Multiply the overtime rate by the total overtime hours.

For example, if your regular hourly wage is $20 and you worked 10 hours of overtime:

| Calculation | Amount |

|---|---|

| Regular Hourly Wage | $20 |

| Overtime Rate (1.5x) | $30 |

| Overtime Hours | 10 |

| Total Overtime Pay | $300 |

In this case, you would earn $300 for the overtime hours worked.

Prorating Bonuses

Bonuses can vary based on performance or company profits. Prorating bonuses ensures fair distribution. Here’s how to calculate a prorated bonus:

- Identify the total bonus amount.

- Determine the time period for the bonus (e.g., yearly, quarterly).

- Calculate the number of months or days worked during that period.

- Divide the total bonus by the total time period.

- Multiply by the number of months or days worked.

For instance, if your annual bonus is $1,200 and you worked 6 months:

| Calculation | Amount |

|---|---|

| Total Bonus | $1,200 |

| Months in Year | 12 |

| Worked Months | 6 |

| Prorated Bonus | $600 |

Your prorated bonus for 6 months of work would be $600.

Credit: www.educba.com

Factoring In Leaves And Absences

Understanding how to calculate salary involves more than just the base rate. Leaves and absences impact the final paycheck significantly. These can include paid time off, unpaid leaves, and sick days. Each category has different implications for the salary calculation.

Paid Time Off

Paid Time Off (PTO) allows employees to take leave without losing income. This includes vacation days and personal time. Here’s how to factor in PTO:

- Identify total PTO days available.

- Calculate the daily wage: Annual Salary / Working Days.

- Multiply daily wage by PTO days taken.

Example:

| Annual Salary | Working Days | PTO Days Taken | Daily Wage | Total PTO Pay |

|---|---|---|---|---|

| $50,000 | 260 | 5 | $192.31 | $961.55 |

Unpaid Leaves

Unpaid leaves reduce the total salary. They occur when an employee takes time off without pay. To calculate unpaid leaves:

- Determine the daily wage.

- Count the number of unpaid leave days.

- Multiply daily wage by unpaid leave days.

Example:

| Annual Salary | Working Days | Unpaid Leave Days | Daily Wage | Total Pay Deduction |

|---|---|---|---|---|

| $50,000 | 260 | 3 | $192.31 | $576.93 |

Sick Days

Sick days are crucial for employee health. Many companies offer paid sick leave. Here’s how to factor sick days:

- Check the company policy on sick days.

- Calculate the daily wage.

- Multiply daily wage by sick days used.

Example:

| Annual Salary | Working Days | Sick Days Taken | Daily Wage | Total Sick Pay |

|---|---|---|---|---|

| $50,000 | 260 | 2 | $192.31 | $384.62 |

Using Salary Calculators

Calculating your salary can be confusing. Salary calculators make this task easier. They provide instant estimates based on your input. Many online tools are available, each with unique features. Understanding these tools helps you make informed decisions.

Benefits Of Online Calculators

- Quick Estimates: Get instant salary calculations.

- User-Friendly: Simple interfaces anyone can use.

- Customizable: Input specific details like location and experience.

- Comparison Tools: Compare salaries across industries or locations.

Online calculators save time. They eliminate the need for manual calculations. Just enter your information and get results.

Limitations And Accuracy

While online calculators are useful, they have limitations. They may not account for all variables. Some calculators use outdated data.

| Factor | Impact on Accuracy |

|---|---|

| Location | Salary varies by region. |

| Experience Level | Years of experience greatly affect salary. |

| Industry | Different sectors pay differently. |

| Benefits | Some calculators ignore bonuses or benefits. |

Consider these factors for accuracy. Always cross-check with reliable sources. Use calculators as a guide, not a final answer.

Credit: m.youtube.com

Common Mistakes To Avoid

Calculating salary accurately is crucial for both employees and employers. Many make mistakes that can lead to incorrect payments. Here are the common errors to avoid.

Incorrect Data Entry

Data entry errors can happen easily. A small typo can change the entire calculation. Pay attention to:

- Incorrect employee names

- Wrong hourly rates

- Misplaced decimal points

Always double-check your entries. Use spreadsheets or payroll software to minimize these errors.

Overlooking Deductions

Deductions can significantly affect salary calculations. Missing deductions leads to overpayments or underpayments. Common deductions include:

| Deductions | Details |

|---|---|

| Taxes | Federal, state, and local taxes |

| Health Insurance | Employee contributions to health plans |

| Retirement Contributions | 401(k) or pension plan contributions |

Review deductions regularly. Make sure they reflect current employee benefits.

Failing To Update Tax Information

Tax information changes frequently. Failing to update it can lead to major issues. Important updates include:

- Changes in tax laws

- Adjustments in employee tax withholding

- New tax brackets

Keep track of tax updates. Regularly review employee tax forms, such as W-4 or W-9. This helps ensure accurate calculations.

Frequently Asked Questions

How Do I Calculate My Salary?

To calculate your salary, determine your hourly wage or annual salary. Multiply your hourly wage by the total hours worked in a pay period. For annual salaries, divide by the number of pay periods in a year. This gives you your gross earnings before deductions.

What Factors Affect Salary Calculations?

Several factors influence salary calculations, including job role, industry, location, and experience level. Cost of living in your area also plays a significant role. Additionally, education and skills can impact your overall compensation. Understanding these factors helps you negotiate better salary offers.

How Can I Estimate My Take-home Pay?

To estimate your take-home pay, start with your gross salary. Subtract taxes, health insurance, and retirement contributions. Use online calculators or payroll software for accuracy. This provides a clearer picture of what you’ll actually receive in your paycheck.

What Are Common Salary Deductions?

Common salary deductions include federal and state taxes, Social Security, and Medicare contributions. Health insurance premiums and retirement contributions, like 401(k) plans, are also typical. Understanding these deductions is crucial to calculating your net pay accurately.

Conclusion

Calculating your salary accurately is essential for financial planning. Understanding factors like base pay, bonuses, and deductions can make a big difference. By following the steps outlined in this guide, you can ensure you know your worth. Take charge of your finances today for a more secure future.